Macy’s has for more than a century stamped its name among the best department stores in America. But, like many other brick-and-mortar stores, the company has managed to extend its success to the online retail world and is not backing down anytime soon. One of the ways it is doing this is through its flagship loyalty program.

This article will review Macy’s Credit Card, American Express Card, and the Star Rewards program, and its significant benefits and drawbacks.

How does the program work?

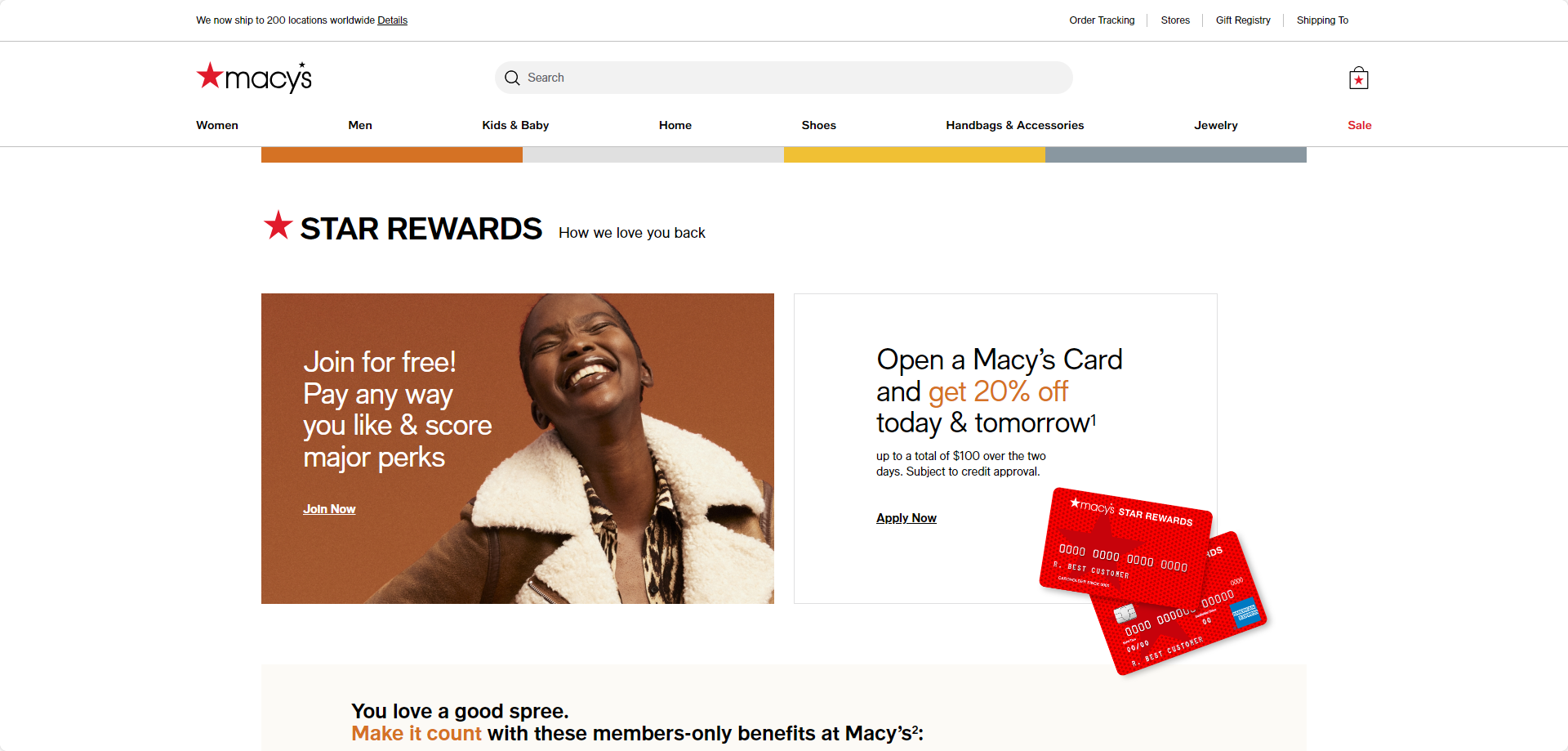

Customers can join the Macy’s Card rewards program by signing up at macys.com. They either can join for free as a Bronze member or apply for a Macy’s Card.

Once an application for a Macy’s card is approved, they enroll you automatically as a Silver Status member in their Star Rewards Program.

Status Tiers

Within the Macy’s Card Rewards program, there are three tiers for cardholders. Once you open a Macy’s card, you’re automatically made a Silver member. However, you can sign up as a Bronze member to shop at Macy’s without a credit card. Apart from the Bronze tier, the remaining levels are determined by the amount a cardholder spends annually with the brand.

Silver- Cardholders who spend between $1 and $499 at Macy’s annually

Benefits

- 25% off any day with Star Passes

- 2% Back in Rewards

- Star Money Bonus Days

- Birthday Surprise

- Perks & Offers (Extra savings, Event Invites)

Gold- Cardholders who spend between $500 and $1,199 with the Macy’s card annually

Benefits

- 3% Back in Rewards

- Free Shipping No minimum at Macy’s with your card

- 25 % off any day with Star Passes

- Star Money Bonus Days

- Birthday Surprise

- Perks & Offers (Extra savings, Event Invites)

Platinum- Cardholders who spend at least $1200 with their Macy’s card annually

Benefits

- 5% Back in Rewards

- Free Shipping No minimum at Macy’s with your card

- 25 % off any day with Star Passes

- Star Money Bonus Days

- Birthday Surprise

- Perks & Offers (Extra savings, Event Invites)

Rewards increase as the customer progresses through the tiers.

The benefits that all members, including non-cardholders, enjoy in this program include:

- Star Money Bonus Days

- Birthday Surprise

- Perks & Offers (Extra savings, Event Invites)

Apart from these benefits, the company offers more rewards with Macy’s American Express Card. With this card, you can redeem your rewards anywhere an American Express Card is accepted. The benefits derived from getting this card are similar to those associated with the Star Rewards program stats. The only difference between the Macy’s Card and Macy’s American Express Card is the ability to use the latter at more places outside of the brand’s stores.

Again, Macy’s American Express cardholders can earn 3% back in rewards at restaurants and food delivery, 2% back at gas stations and supermarkets, and 1% back anywhere outside of Macy’s.

In this program, 1,000 points are equivalent to $10 Star Money. Thus, when a cardholder earns enough points or surpasses the threshold, they can redeem their Star Money by applying it at checkout for any product they purchase online or in-store.

Macy’s Star Money, however, expires 30 days after the date of its issue.

What are the good things about the program?

Valuable Offers

One of the main reasons Macy’s Card Rewards has been successful is its immense value in its loyalty program. The program covers all of Macy’s customers, including those who hardly shop or spend as much. Members who join for free by becoming Bronze members do not have a card but can still enjoy some benefits for shopping. As a cardholder, the brand offers even more valuable rewards to customers who regularly shop with them. Members can take advantage of event invitations, extra savings, birthday offers, and special days where they can earn more points. As members advance through the tiers, they can also enjoy free shipping for any purchase they make and early access to sporting and concert tickets when they utilize their Macy American Express Card. The amount of value and exclusivity derived from these perks is enough to keep members repeating purchases and sticking with the brand in the long term.

How could they have made their rewards program more attractive?

Like every other rewards program, Macy’s Card has a few drawbacks that it could work on to make the program more attractive.

The most obvious is the limit to the number of rewards and points you can earn if you’re not yet a Platinum member. If you happen to be at the Gold or Silver status, it is challenging to earn points outside Star money days. This could be particularly discouraging for such members. Numerous retailers reward points or incentives to their customers for each purchase they make. This makes customers feel appreciated and motivated to keep coming back to your store. Macy’s can make the program more attractive by introducing more incentives linked to profitable customer activities.

Another thing Macy’s can work on is to make their rewards more diverse. Amidst the prior difficulty in earning points for lower status members, customers who can finally earn points can only redeem them at Macy’s. While the company has a wide range of merchandise, it appears customers do not have as much freedom in using their rewards. This same restriction applies to the 3-2-1 program with Macy’s American Express Card. Most customers would enjoy the program better if they could have more freedom to utilize the rewards earned anywhere they want.

Finally, another drawback of Macy’s Card rewards is that the cards have a high APR, at 27.49%. This means that customers can easily wind up paying high interest and penalty rates if they cannot pay off their balance on time and in full every month. While this is a precautionary measure, it can be discouraging to new customers who are very concerned about APRs.

Wrapping Up

Despite the above drawbacks, the Macy’s Card rewards program appears to be a perfect fit for its most loyal customers and those who enjoy shopping at Macy’s. In any case, that is the purpose of this and many loyalty programs.